Realty Cash Flow Investments: A Guide to Structure Steady Earnings

Realty capital financial investments have actually long been a preferred for capitalists seeking regular earnings streams while building riches. Unlike standard stock or bond financial investments, real estate uses tangible, income-producing properties that can offer regular monthly or quarterly returns. If you're looking to begin or improve your profile in real estate cash flow financial investments, this guide covers the fundamentals, kinds of capital properties, and techniques to maximize returns.

What Are Real Estate Cash Flow Investments?

Cash flow in realty describes the net income a building creates after accounting for costs like home mortgage payments, property taxes, insurance, and upkeep prices. Favorable capital investments take place when rental earnings exceeds expenditures, leaving capitalists with earnings. Many view realty cash flow as a secure and predictable means to gain income, whether with residential rental properties, business structures, or various other types of income-generating real estate.

Why Think About Realty Capital Investments?

Steady Revenue Stream

Capital financial investments provide regular income, which can be reinvested, made use of for expenses, or saved. Unlike supplies, which depend heavily on market conditions, rental income tends to remain more stable, making it optimal for risk-averse financiers.

Tax Benefits

Financiers can take advantage of tax deductions, such as depreciation, home mortgage rate of interest, and property-related costs, which can minimize gross income.

Appreciation Possible

Gradually, property worths tend to value. This dual benefit of recognition and cash flow can develop a durable investment chance that develops wealth over the long term.

Control and Tangibility

With real estate, you have control over residential property monitoring decisions, tenant choice, and renovation alternatives, offering even more control over capital than traditional financial investments.

Kinds Of Realty Cash Flow Investments

Single-Family Rentals (SFRs).

These are standalone residential or commercial properties rented to individuals or family members. SFRs are normally simpler to manage, extra affordable for novice financiers, and tend to bring in longer-term occupants, reducing turn over rates and openings costs.

Multi-Family Features.

Multi-family residential properties include duplexes, triplexes, and apartment. These homes offer the benefit of multiple income streams from a solitary home, which can boost cash flow possibility and reduce openings threats.

Commercial Real Estate.

This consists of office complex, retail spaces, and industrial residential or commercial properties. Industrial leases are frequently long-lasting, giving stable earnings and normally moving some upkeep costs to occupants, which can boost cash flow margins.

Vacation Rentals.

Short-term leasings like vacation homes or Airbnbs can offer considerable earnings, particularly in high-demand places. Although they might need a lot more energetic monitoring, the possible capital can be high, especially in popular traveler destinations.

Mixed-Use Feature.

Mixed-use residential properties integrate residential, business, and occasionally even retail areas. These residential or commercial properties benefit from varied earnings streams and can flourish in locations with high foot website traffic or metropolitan charm.

Key Approaches to Make The Most Of Cash Flow.

Place is Secret.

The property's place is just one of the most crucial determinants of rental need and residential property recognition. Concentrate on locations with low openings rates, high rental need, and future growth possibility.

Efficient Building Administration.

Taking Real estate cash flow investments care of expenses and maximizing rental earnings can make a substantial difference. Utilizing a reliable home supervisor, staying on top of repair services, and establishing affordable rental fees can boost capital.

Regularly Testimonial Rental Rates.

Making sure leas are at or a little above market degrees assists take full advantage of income while maintaining tenants pleased. Carrying out periodic lease reviews and comparing to regional market prices ensures you're not leaving cash on the table.

Enhance Lending Terms.

Funding terms can impact capital considerably. As an example, selecting a loan with a reduced interest rate or a longer amortization duration can lower regular monthly repayments, improving web capital.

Minimize Openings.

Keeping turnover prices reduced assists preserve consistent cash flow. Dealing with tenants well, supplying rewards for revivals, and making sure smooth property administration can lower vacancy rates and turn over expenses.

Think About Value-Add Investments.

Often small renovations, like updating kitchen areas or shower rooms, can permit you to charge higher leas and boost lessee fulfillment. These value-add renovations can lead to higher cash flow with fairly reduced ahead of time prices.

How to Calculate Cash Flow in Realty.

Prior to spending, it's vital to recognize how to calculate cash flow:.

Gross Rental Revenue.

This is the total income the residential or commercial property produces from lease and any additional fees (e.g., family pet fees, car parking).

Operating Costs.

Includes all monthly costs associated with the property, such as real estate tax, insurance policy, maintenance, management costs, utilities, and repair services.

Financial obligation Solution.

The month-to-month home loan repayment, which includes principal and rate of interest.

Web Operating Income ( BRAIN).

Deduct business expenses from the gross rental earnings. This number represents income before financial debt service.

Cash Flow.

Finally, deduct the debt service from the NOI. If this number declares, the residential or commercial property has a positive capital, which implies it's generating profit.

Example Calculation:.

Gross Rental Earnings: $2,500/ month.

Operating Expenditures: $500/month.

Financial debt Service: $1,200/ month.

NOI = $2,500 - $500 = $2,000.

Cash Flow = $2,000 - $1,200 = $800.

In this example, the capitalist would make a month-to-month capital of $800.

Threats in Property Cash Flow Investments.

While real estate cash flow financial investments can be successful, they come with some threats:.

Openings Danger.

Prolonged vacancies can injure capital, especially in areas with high renter turn over or seasonal need. Correctly examining rental demand can mitigate vacancy dangers.

Upkeep Prices.

Unforeseen repairs or high upkeep expenses can eat into earnings. Building a upkeep get and planning for regular repair work is critical for lasting sustainability.

Market Variations.

Real estate markets can be intermittent, and property worths might vary. While capital can remain constant, slumps out there can influence appreciation potential.

Tenant-Related Issues.

Managing difficult renters, late settlements, or building damages can stress capital. Proper occupant testing and regular residential property checks can assist minimize these threats.

Tips for Beginning in Real Estate Cash Flow Investments.

Begin Small.

Novices might discover single-family leasings a lot more convenient and budget-friendly. Beginning tiny permits you to obtain experience without overwhelming financial commitments.

Work with Experts.

Speak with realty experts, including real estate professionals, property managers, and economic experts, that can provide valuable understandings and aid you make educated choices.

Inform Yourself.

Discover real estate fundamentals, tax benefits, and neighborhood markets. Participating in workshops, signing up with realty investment groups, and reading trusted resources can be beneficial.

Hold your horses.

Constructing a money flow-positive realty portfolio takes time. Remaining constant, gaining from experiences, and reinvesting profits can yield https://sites.google.com/view/real-estate-develop-investment/ substantial returns over the long term.

Real estate capital financial investments provide an effective means to produce stable income while constructing long-lasting wealth. By picking the ideal residential or commercial property type, making the most of capital methods, and thoroughly computing prospective returns, you can create a successful portfolio that fulfills your monetary goals. Whether you have an interest in single-family rentals or business homes, real estate cash flow investing can be a reliable possession for creating economic safety and security and easy income.

Jonathan Lipnicki Then & Now!

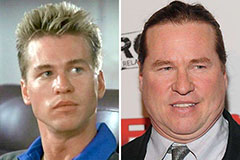

Jonathan Lipnicki Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Kenan Thompson Then & Now!

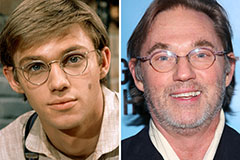

Kenan Thompson Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!